Which Customer Segments are Healthiest During the Downturn?

In CloudFlare’s latest earnings report, the management team highlighted the strength of enterprise buyers within their customer base.

I wondered if this were broadly true. Do public software companies with largely enterprise customer bases benefit from superior growth to their peers with mid-market or SMB focuses?

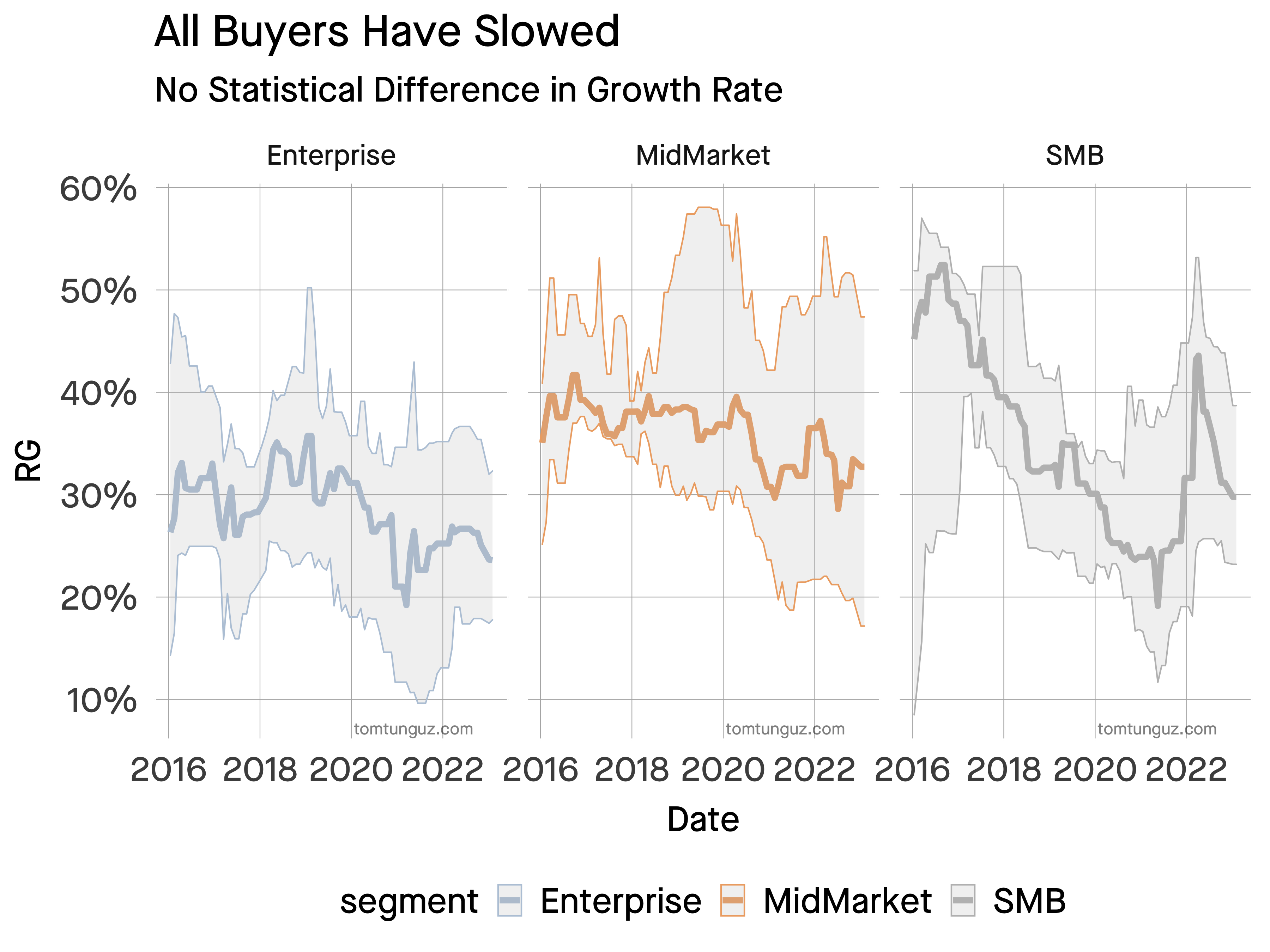

Enterprise & Mid-Market public companies have seen a relatively constant decline in growth rates through the last six years. SMB businesses benefited from a post-Covid surge when the US re-opened - a phenomenon that seems to abate with time.

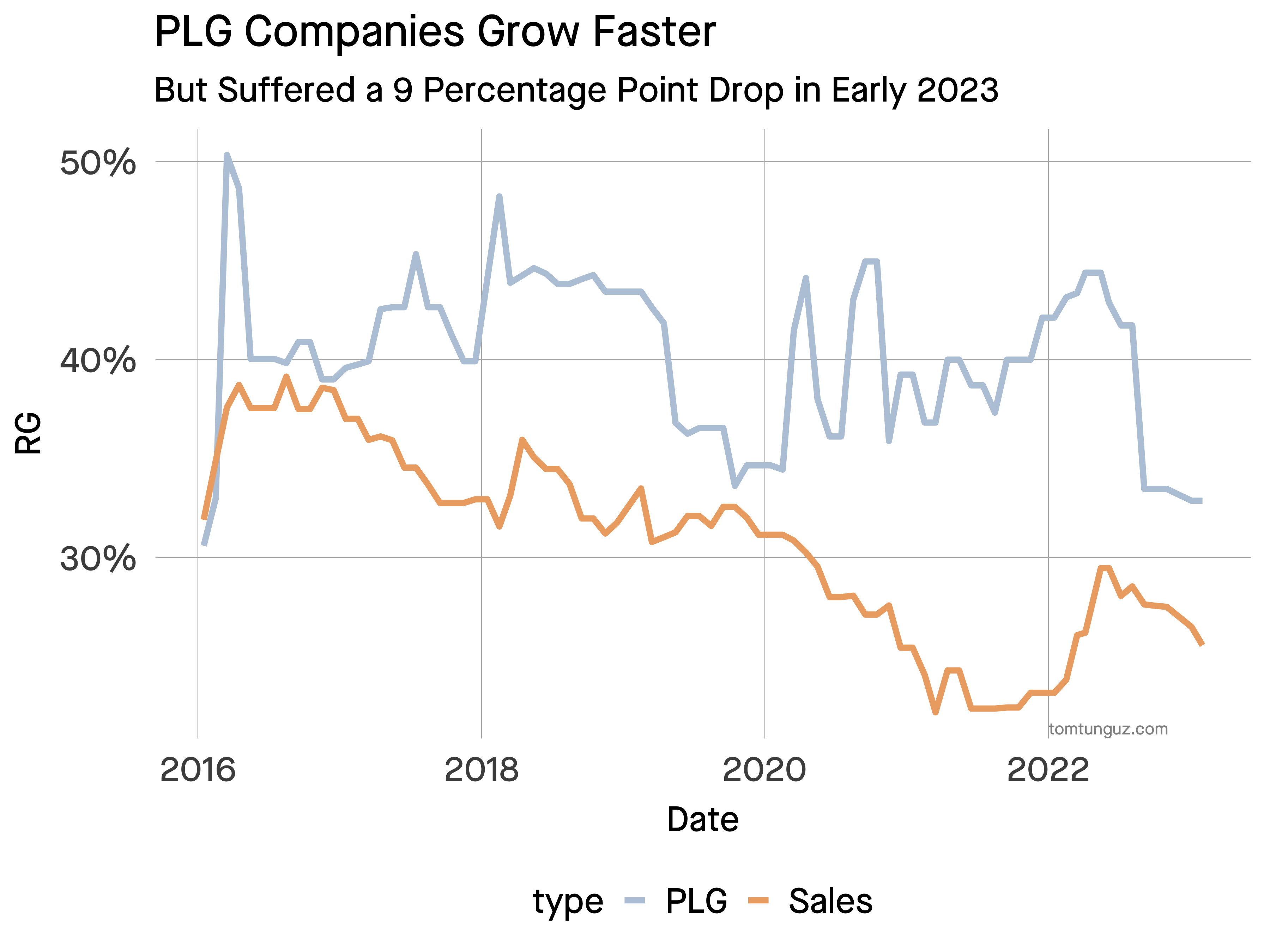

Product-Led companies continue to outpace Sales-Led Companies in growth. However, PLG suffered a 9 percentage point drop in growth rate in Q2.

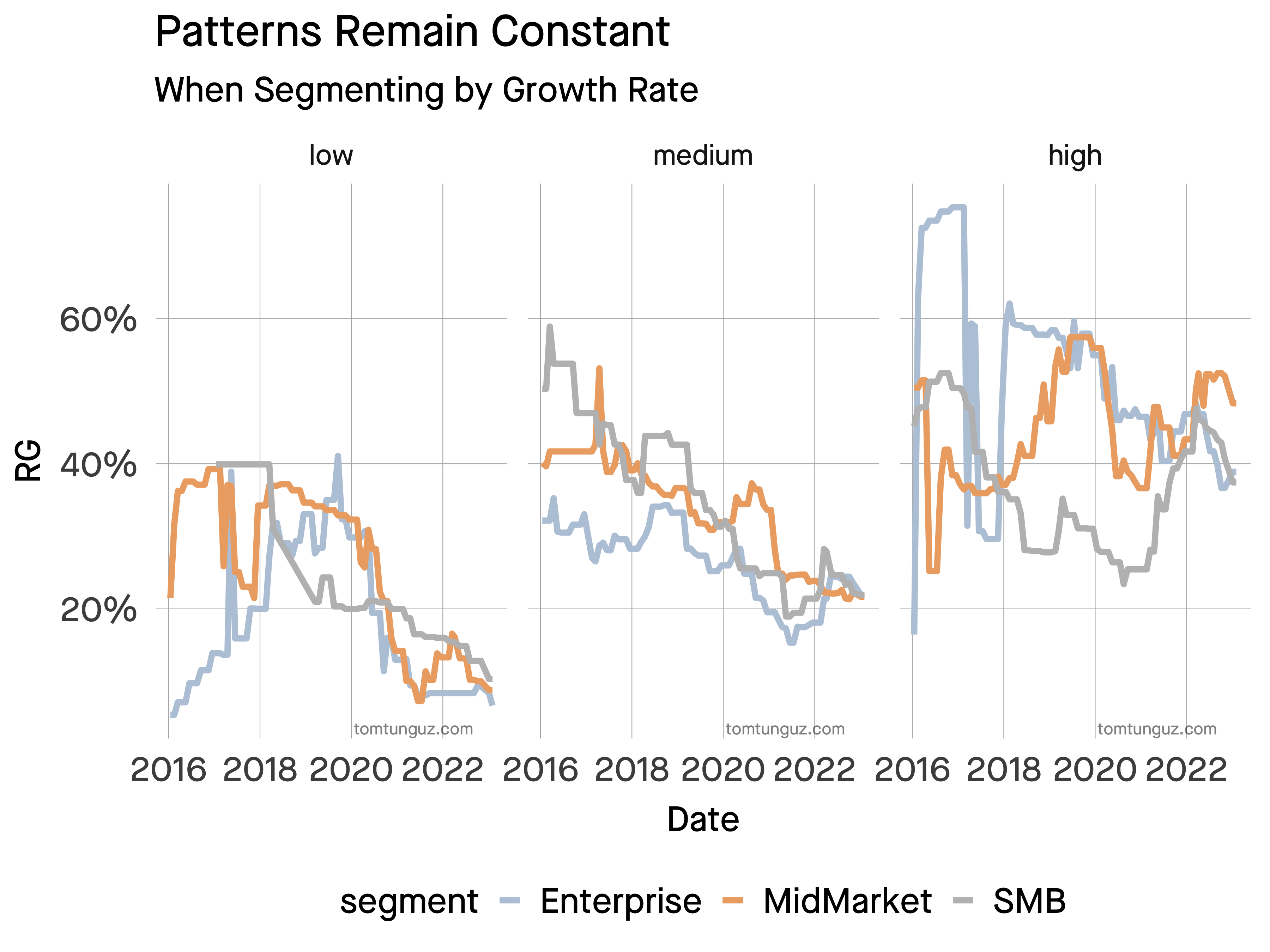

Segmenting the population by growth rate yields the same conclusion. Low growth is < 15%, Medium growth is 15 - 30%, High growth is 30%+. The behavior across buyer sizes parallels each other.

The data so far suggests the economic slowdown has struck across the industry similarly. Variations will surely emerge between competitors as a result of differences in product, execution, or strategy. But no one is immune. Something to consider for 2023 planning.